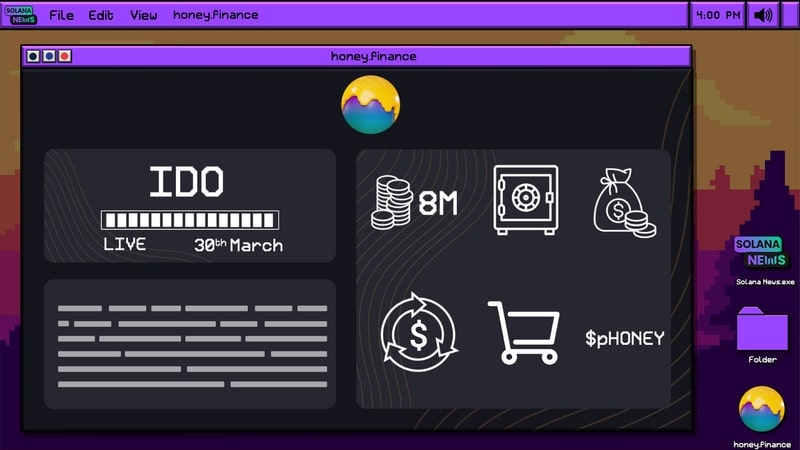

As the mainnet launch approaches, Honey´s much-anticipated IDO is taking place.

Turning NFTs Into Powerful DeFi Assets

The DeFi protocol for NFTs Honey is launching its IDO on March 30 at 5:00 pm UTC, lasting 24 hours until March 31.

The team announced the initial DEX offering on March 22 via Twitter. The protocol has allocated 85 million tokens, or 8.5% of the total supply, to the event. It uses Mango´s token sale method, allowing the market to establish the price through supply and demand.

Tom Pandolfi, Founder of Honey Labs, wrote on his Medium blog about the importance of being community-funded instead of VC-funded:

“There are times where projects simply don’t have a choice but to resort to private funding, but our motivation to become profitable early on has given us a lot of freedom to operate. Our belief is that we should mirror the platonic ideal of what a decentralised protocol can be, and in our minds that means funding the DAO with a fair launch.”

To participate in the IDO, investors will need to have $USDC in their wallet (i.e., Phantom Wallet) and some $SOL to pay for the fees. The $HONEY token’s price will fluctuate for 24-hours as investors deposit $USDC in a smart contract vault. Once the deposit phase has expired, they can return to the IDO page and collect their $HONEY tokens.

Only one hour after the IDO started, it had already raised $90K at 0.00104 USDC per $HONEY token. You can participate here.

What is Honey?

Honey is a liquidity solution for NFTs on Solana. It allows users to extract value from their NFTs without selling them to generate yield or mint more NFTs. Borrowers use their NFTs as collateral to obtain loans, and lenders supply liquidity to earn interest and gain exposure to NFTs.

The protocol aims to bridge the gap between NFTs and DeFi, ensuring that every NFT holder can be empowered with the same opportunities and yields as DeFi users.

Find more about Honey here:

Source web3wire.news

Website | App | Twitter | Blog | Docs |IDO